UK Housing Market: 2022 Summary, 2023 Predictions

Despite the pandemic in 2021, house sales in the UK boomed. The real estate industry had the best of years in 2021. Due to the high demand and lack of homes on the market, a house price rise seemed inevitable.

Nationwide reported that housing prices had increased by 11% over the year 2021 and official data showed that they remained approximately 13% higher than before the pandemic.

So what happened to the UK housing market 2022? Calling it a crazy year would be a dangerous understatement. In this article, we talk about that, and how the UK real estate market is projected to perform in 2023.

UK Housing Market in Q1 of 2022

Sheer growth

UK property prices rose – over the year – by 9.8% on average, at the end of the first quarter of 2022. The average UK house price stood at £278,000, which was £24,000 higher than in March 2021.

The highest house price growth was seen in East Midlands at 12.4% and the lowest in the capital at 4.8%. According to the RICS Residential Market Survey, this surge in house prices was due to a modest increase in buyer demand and sales.

According to the National Statistics House Price Index, people who purchased a home using a mortgage had to pay an extra £27,317 on average compared to paying full in cash.

The number of residential property transactions valued at £40,000 or more in the UK in March 2022 was approximately 114,650, according to the UK Property Transactions Statistics. This represents a decrease of 35.7% from the same period in the previous year.

Rents skyrocketed during this time. According to HomeLet’s rental index, the average monthly rent in the UK was £1,078 in Q1 2021. That was a record high!

Scotland reported the highest annual rent rise (12.9%, £770 pcm). The cheapest rent was in the North East. At only £589 it was almost 50% less than the national average in Q1 2021.

UK Housing Market in Q2 of 2022

Taxation and first cracks

From Q2 2021 to Q2 2022, the annual property price inflation slowed down as a result of tax break changes, but still ended up £20,000 higher. However, from March to June, the average house price increased by £8,000. The East of England saw the largest increase in house prices at 9.7%, while the North East saw the smallest increase at 3.6%.

According to the Bank of England’s Agents summary for the second quarter of 2022, there was a slight increase in the number of properties available for sale in the UK.

UK Property Transactions Statistics reported that between May and June 2022, property transactions decreased by 7.9%. In the same period, mortgage approvals also fell to 63,700 from 65,700 in May 2022.

At the end of June 2022, renters across the UK spent an average of 30% of their income on rent as the average rent reached a new record high of £1,113. Homelet’s Rental Index for Q2 2022 also reports that the strongest rent growth was in Westminster with a 27.8% increase. The weakest regional rental growth was seen in Enfield with only a 5.2% increase.

UK Housing Market in Q3 of 2022

Stamp duty impacts prices

The annual year-on-year UK house price slowed down at the end of Q3 2022. This was due to Stamp Duty Land Tax changes in September 2021 which resulted in a sharp rise in UK house prices.

In September 2022, the average house price in the UK was £295,000, representing an increase of £26,000 compared to the same time the previous year and a £9,000 increase compared to the second quarter of 2022.

Regionally, average house prices rose by 9.6% to £314,000 in England, by 12.9% to £224,000 in Wales, by 7.3% to £192,000 in Scotland, and by 10.7% to £176,000 in Northern Ireland.

According to the Royal Institution of Chartered Surveyors’ September 2022 UK Residential Market Survey, there has been a continuous decrease in new buyer inquiries for the fifth month in a row, and the supply of properties on the market remained limited.

The estimated number of residential property transactions worth £40,000 or more was 103,930, a decrease of 36.8% compared to Q3 2021. Mortgage approvals in Q3 2022 increased to 66,800 up from 63,700 in June.

As for the rental market, the average UK rent reached £1,159 PCM, which was £46 higher than in Q2 2022. London reported a huge rise in monthly rent (£1,945 PCM), making it unaffordable, and lost tenants to cheaper neighbourhoods.

UK Housing Market in Q4 of 2022

Interest rate strikes

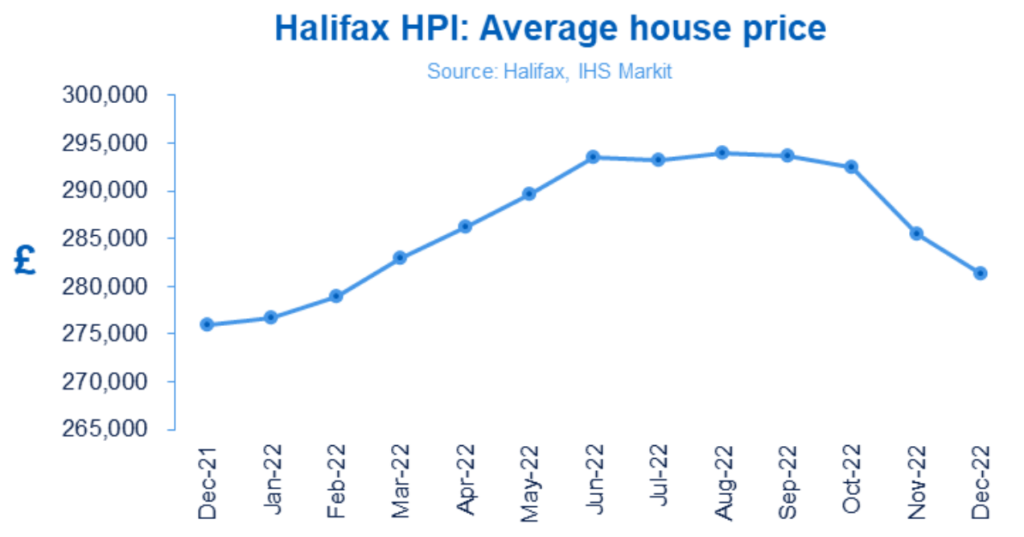

According to the Halifax house price index, the average UK house price dropped to £281,272 at the end of 2022. This was the fourth consecutive monthly drop after rising to record levels – 2.4% in November and 1.5% in December.

From Q3 2022 to Q4 2022, house prices dropped by £13,728. However, the average UK house price was still above the starting price in January 2022, even though the annual increase slowed.

Screenshot courtesy of Halifax house price index December

In December, the Bank of England increased the interest rates to 3.5%. This was the ninth rate hike in 2022 alone, the highest in 14 years. The bank also informed burrowers to expect more interest rate hikes in 2023.

In November, property sales (seasonally adjusted) increased to 107,190, according to HMRC. On a year-on-year basis, property transactions were 13.3% higher than in November 2021.

Mortgage approvals dived down to 46,075, down from 66,800 in Q3 2022. This is a 33.2% fall from November 2021.

After consecutive increases, the average UK rent fell for the first time since November 2021 to £1,174. While all regions in the UK saw steady rent growth, London continued its reign, staying above £2,000.

UK housing market 2023 predictions for 2023 and beyond

In 2022, the UK housing market was impacted by wide economic events. Kim Kinnaird, director of Halifax suggests this will be the same in 2023. “We expect there will be a reduction in both supply and demand overall with house prices forecast to fall around 8% over the year,” Kinnaird said.

Rightmove expects lower property transactions in Q1 and Q2 of 2023, courtesy of low new buyers’ interest since the mini-budget.

Savill’s, on the other hand, predicts a -1.0% annual house price growth at the end of 2023 and expects steady positive growth until 2026.

According to the Bank of England, approximately 4 million homeowners are at risk of defaulting on their debt in the next year, which will cause their monthly payments to increase. The BoE also said that the number will reach 6 million at the end of 2025.

Andy Halstead, CEO of HomeLet believes that 2023 will be challenging for the private rental sector. Tenants and landlords both name cost of living as their main concern for the next year.

How landlords and tenants can leverage the UK housing market in 2023

Adjoin’s rent-to-buy scheme is a win-win for both landlords and tenants. Despite the fluctuations that the UK housing market may experience in 2023, our plan creates the opportunity for landlords and tenants to weather this turbulent market environment.

Landlords – afraid you may need to sell at a huge discount now? Rent out to our tenants, who have skin in the game, as they are your potential future buyer. When the tenant buys they will do so at a price that works for both of you, saving you time and money on any exuberant sales commissions.

Tenants – frustrated with the rental market and wary that interest rates are still way up? Rent now and try a property you may want to buy in the future. Moreover, paying rent becomes a means to generate housing wealth. In the end, you will be the first buyer in line, which means no gazumping when market conditions improve, saving you potentially a lot of time and money.

Want to know more about enrolling in our program and getting the best out of the UK housing market in 2023? Drop us a line at info@adjoinhomes.com or register your interest now.